Property purchaser qualification at Coposit

Overview & challenge

Coposit is a payment service provider that allows buyers to secure an off-the-plan property with an affordable deposit starting from $10k.

Financiers set strict quotas for developers on the number of properties that can be sold using Coposit due to concerns about the buyers' ability to complete weekly payments and reach settlement. To address this, Coposit introduced a buyer qualification process to gain financiers' trust and ease restrictions on developers.

Team

UX/UI Designer (Me)

Product Manager

Web Developers

Head of Customer Qualification

My responsibilities

User research

Wireframing

Prototyping

Tools

Figma

Askable

Timeframe

8 weeks

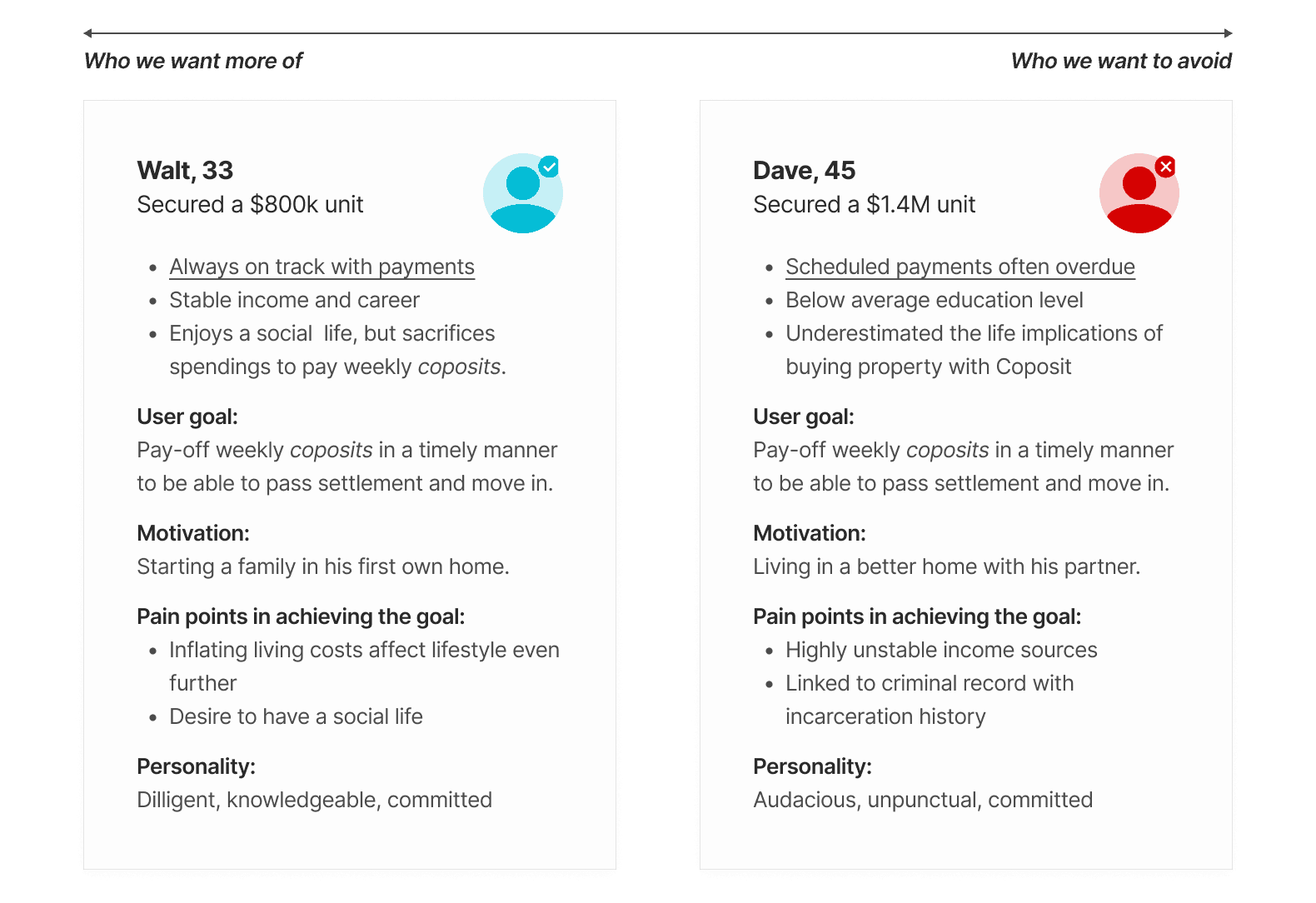

Image: Personas explored

Approach

We wanted to investigate the root cause of possible late payments

What we did:

5x 1h interviews with existing customers to understand pain points in completing weekly payments

collaborative workshops to identify key user insights, personas and themes

early ideation sessions involving the Head of Customer Qualification at Coposit to develop potential solutions to the actionable insights

collecting data points needed to assess customers financial profile

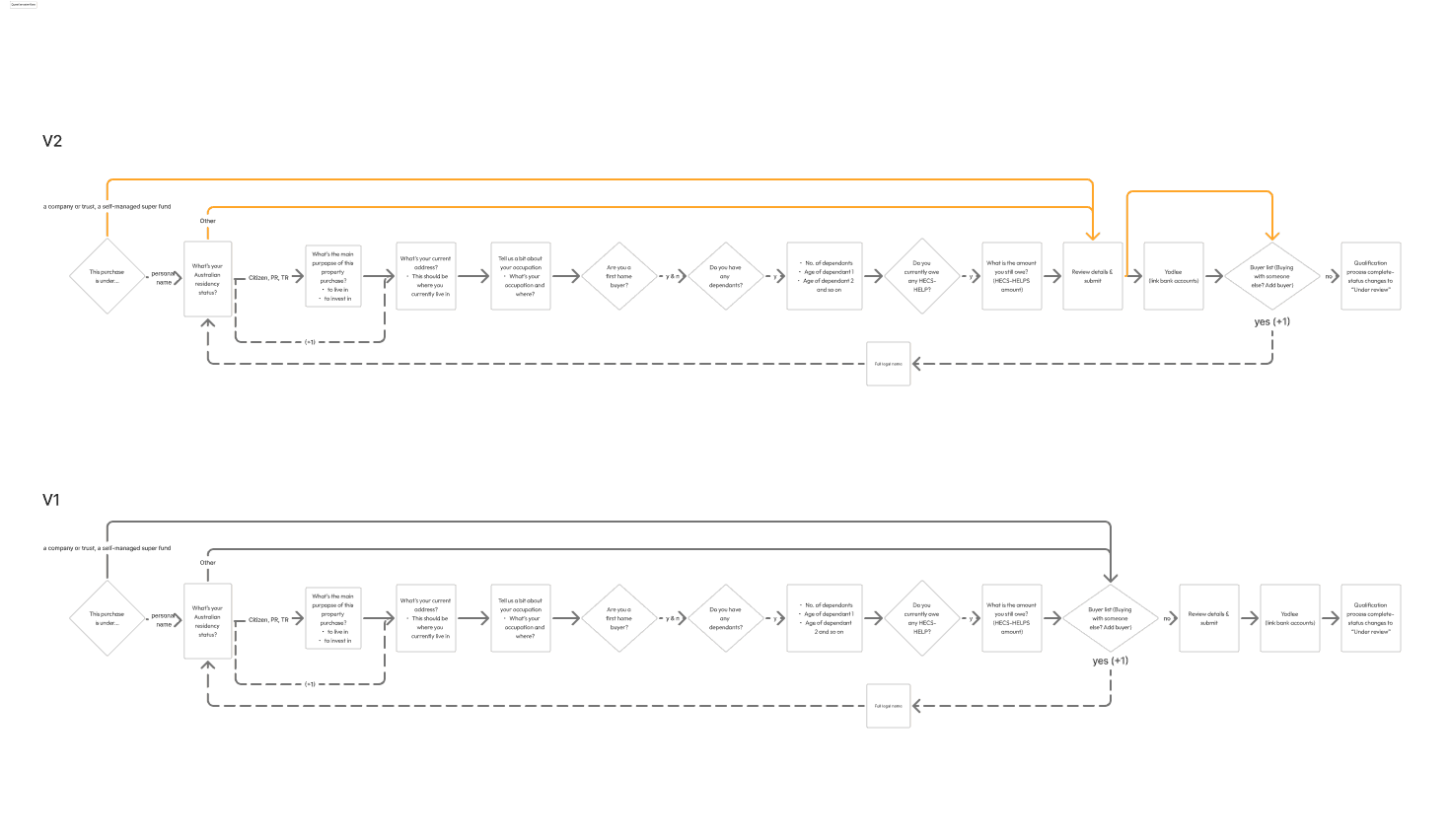

wireframing and testing the qualification flow internally

UI design for the whole prototype flow in preparation for development

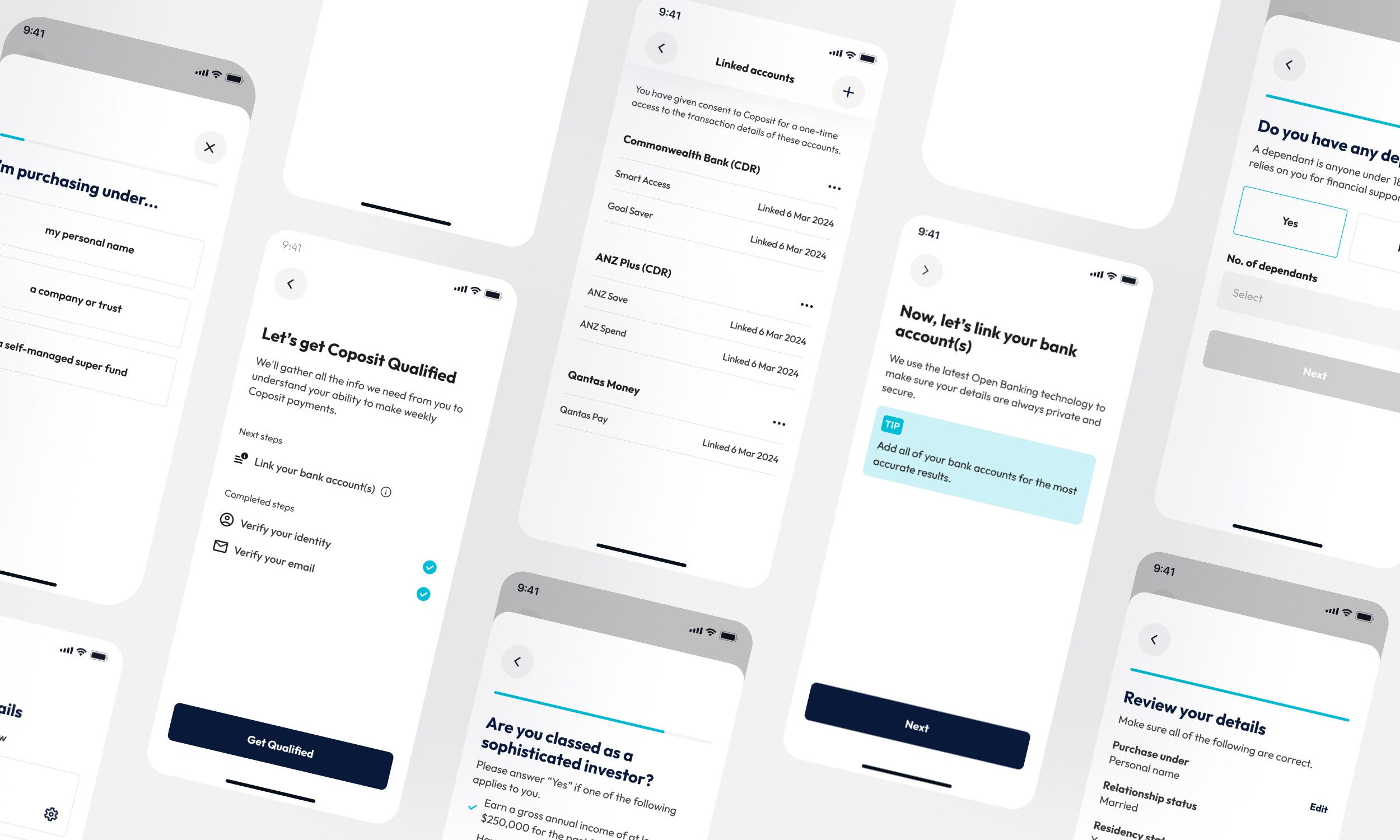

Image: Qualification flow ideation

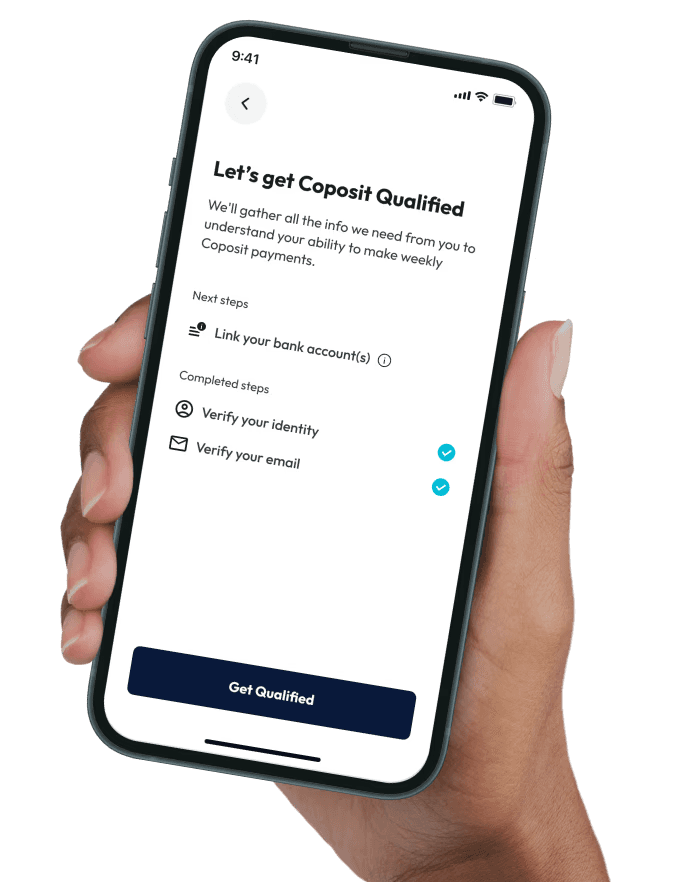

High-fidelity prototype

Scenario

A purchaser who have just paid their holding deposit.

Prototype: Qualification flow

Outcome

Earning trust from major banks

The go-live of the qualification system paved way to the policy change by CommBank, which allows property developers to sell a much higher portion of their projects using Coposit.