Property purchaser qualification at Coposit

Overview

About Coposit

Coposit is an Australian payment service provider for affordable home deposits starting from $10k to buy off-the-plan properties. Traditionally, a 10% deposit paid in a lump sum is needed to secure a property. With Coposit, only $10k is required upfront, followed by interest-free and fee-free weekly instalments paid weekly over the construction time.

Project background: a critical business requirement

This project started as a result of a few major business considerations.

Property developers that sell properties using Coposit were imposed tight quotas by their financiers on the number of units that can be secured by purchasers using Coposit. This was because financiers were concerned on whether the buyers can complete their weekly payments contributing to the deposit and achieve settlement, given the lack of knowledge on the financial profile of Coposit purchasers. To raise concerns, Coposit found out internally that a number of its existing buyers had issues in keeping up with weekly payment commitments.

Overall, these issues posed a threat to the business, so the decision came to be to introduce a qualification process for buyers, with the hope of earning financiers trust such that they're able to lighten restrictions to property developers using Coposit.

Team

UX/UI Designer (Me)

Product Manager

Web Developers

Head of Customer Qualification

My activities

User research

Wireframing

Prototyping

Tools

Figma

Askable

Timeframe

8 weeks

Glossary for the above

Off the plan: Committing to purchase property that hasn't been built

Financier: The lender or funding institution allowing property developers to acquire capital to build and sell their projects.

User research

Investigating the root cause(s)

To gain insights into the underlying reasons for late payments, interviews were conducted with a sample of Coposit purchasers who had experienced payment difficulties. Customer support records were also analyzed to identify common patterns and challenges.

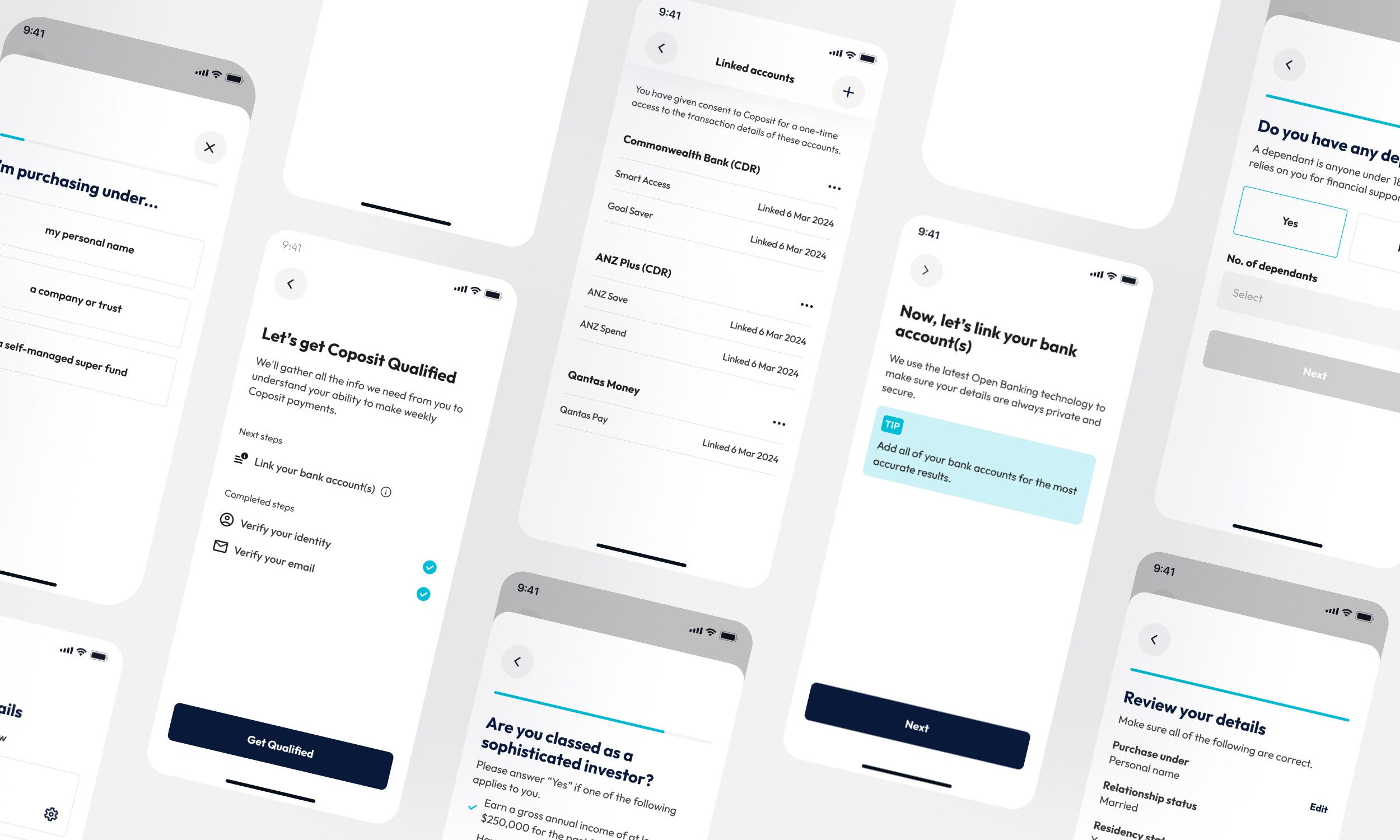

Image: Personas explored

Weekly schedule misaligns with most earning patterns

Payment frequency is strictly weekly, limiting the flexibility to match/align with when people get their wages or income paid.

Purchasers underestimated the impact on lifestyle

Some purchasers, especially first-home buyers underestimated the real-life implications that committing to Coposit weekly payments had on their lifestyles.

Unforeseen life changes affect ability to pay

Some purchasers experienced unexpected financial challenges mainly due to increased living expenses, impacting their ability to meet weekly payment commitments.

Feeling of being indebted can affect mental state

Some purchasers can feel anxious at times, knowing that they need to meet payment deadlines and that they're being indebted.

How do we collect customer data that's most relevant to Coposit's assessment?

Early ideation

Collaboration with senior mortgage broker

To understand what info is required for the assessment, the product team collaborated with the Head of Customer Qualification, who is also a senior mortgage broker with experience in assessing property buyers for mortgage.

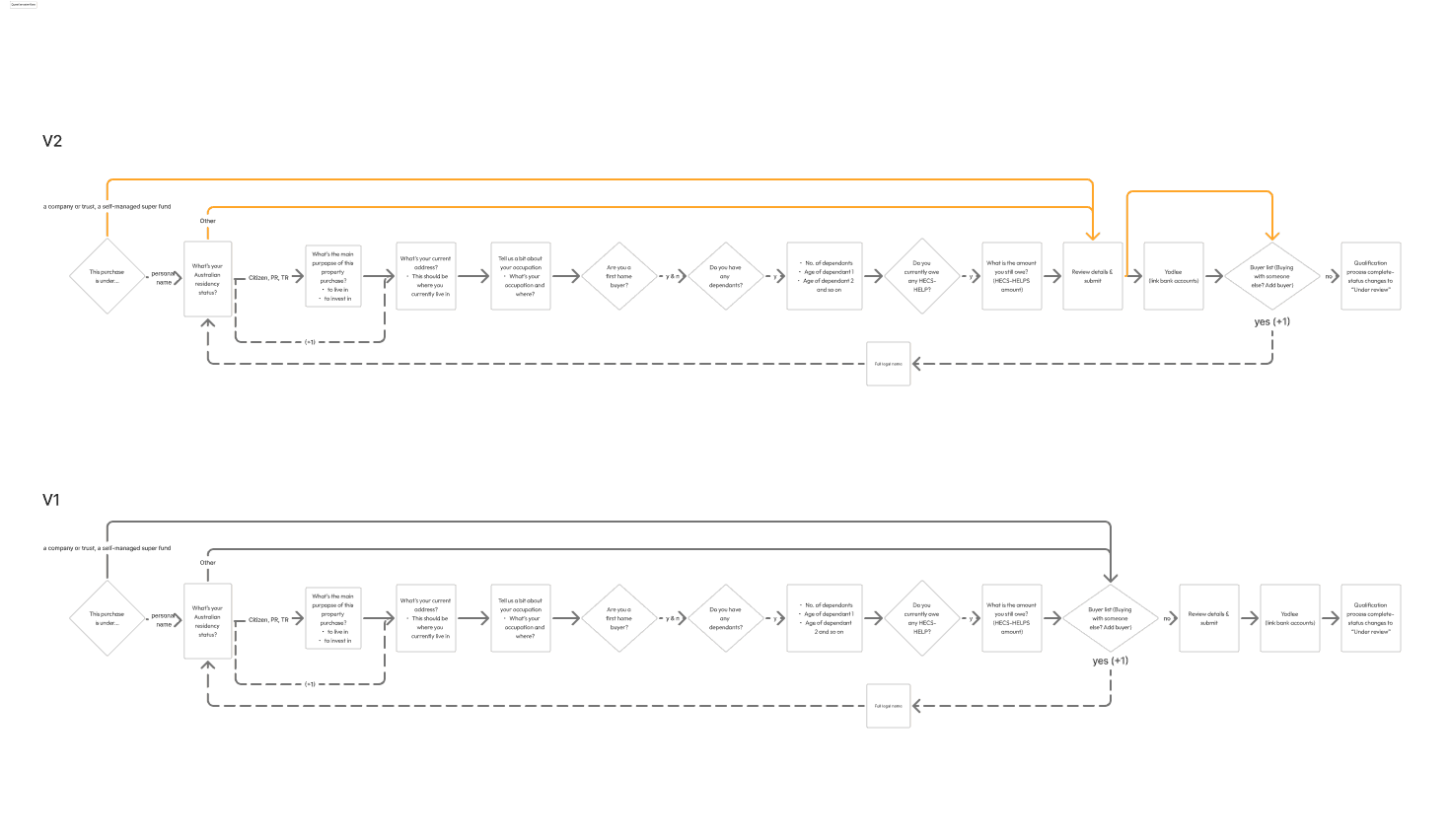

Strategising the flow to minimise conversion barrier

While qualification would become a manadtory step for customers, we had to ensure it wasn't an entry barrier for them to pay the holding deposit. This is the very first transaction as part of the initial deposit allowing buyers to reserve their property lot or unit number. Thus, we decided to insert the qualification process after requesting the holding deposit payment.

Use of open banking for accurate data collection

Open banking was the preferred way to conveniently gather actual financial data of customers so that we could come up with an outcome of their assessment more quickly.

Image: Qualification flow ideation

How can we fulfill business needs, user needs and technical guidelines?

Design

Enabling qualification while awaiting holding deposit payment

While purchasers can only get their Qualification assessed if they've paid the required holding deposit, we decided to allow them to start answering the questionnaire once they have sent their funds (for push payments) or processed their payments (for pull payments) to save them time.

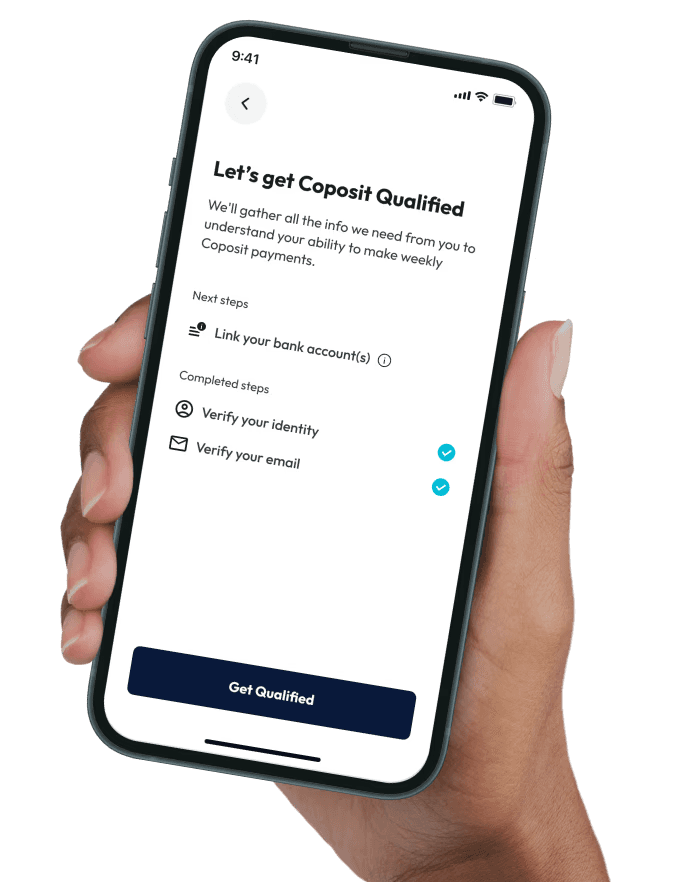

Image: Project details page UI

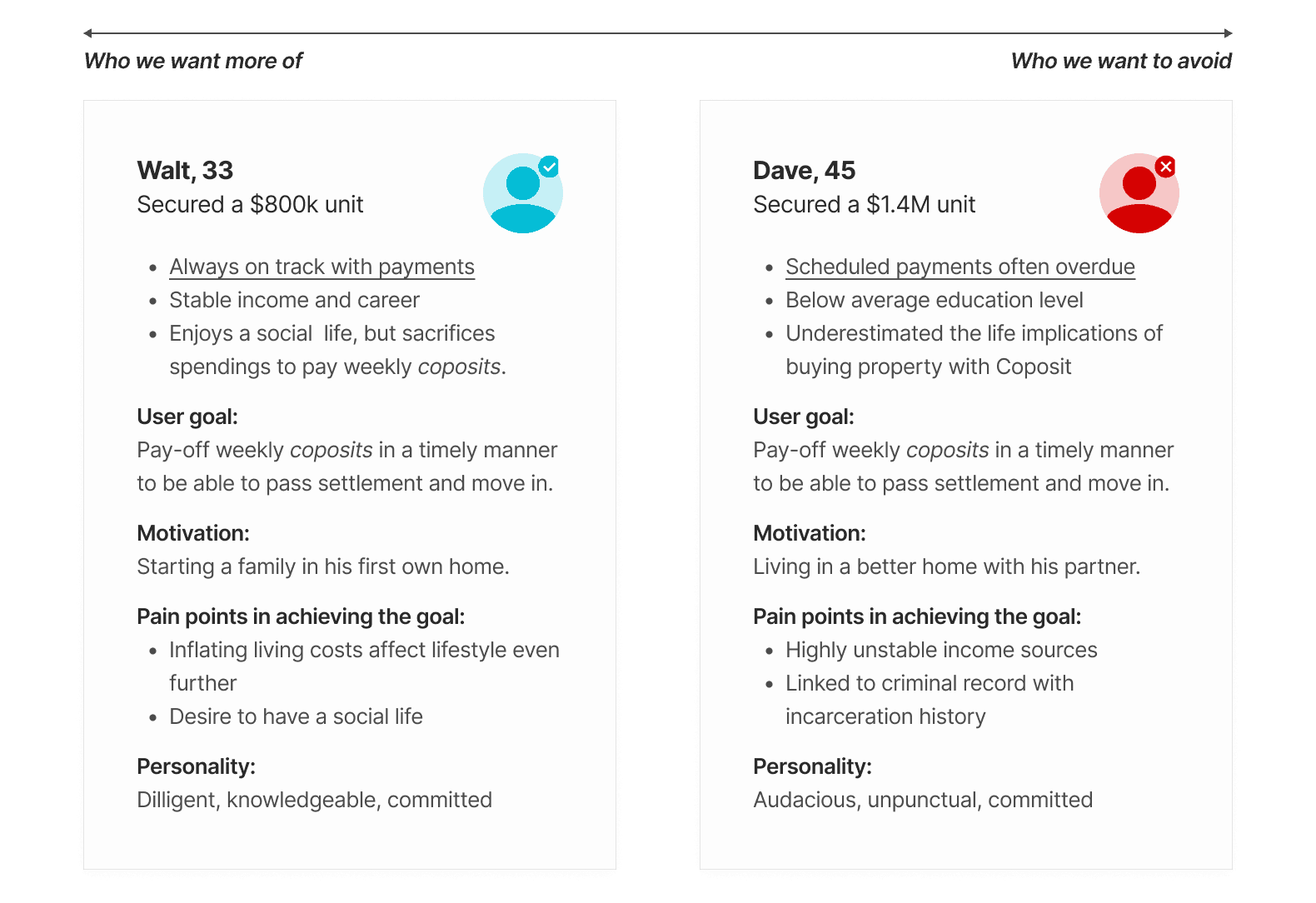

High-fidelity prototype

Scenario

A purchaser who have just paid their holding deposit.

Prototype: Qualification flow

Outcome

Earning trust from major banks

The go-live of the qualification system paved way to the policy change by CommBank, which allows property developers to sell a much higher portion of their projects using Coposit.

Areas for improvement

Currently when a co-buyer is added, the sharing of their details and the open banking authorisation is done on the main buyer's mobile device, with a lack of a consent process, which could raise ethical concerns. To address this issue in the near future, a different approach for the co-buyer to share their details on their own could be implemented .